Net Worth Over Time In Quicken For Mac

Tracking Your Net Worth Over Time While knowing your net worth at any given time can be useful, you should also track how your net worth changes over time. If you use software like Quicken to manage your income and expenses, you can see how your net worth increases as you progress toward your financial goals. Compare Net Worth Changes Over Time. Your net worth at any given time is just a snapshot of how you're doing at the moment, but unless you compare how it's changed over time, you won't know if you're improving or declining. One of the biggest new features for 2018 is Quicken’s expanded Mac options. For the first time, Mac users can decide between different products based on what suits their needs.

If you're trying to go paperless, it's worth a try.

Liabilities Defined Liabilities are amounts that you owe to other people or entities. These can include installment loans like student loans, mortgages or personal loans, as well as revolving debts like your credit card balances. For example, if you have a $100,000 mortgage, $20,000 in student loans and $5,000 in credit card debt, you have $125,000 in liabilities. Limitations of Net Worth Your net worth might tell you how much money you have, but it doesn't necessarily guarantee that you can access enough of it to pay your bills as they come due. Some assets, like the value of your home or money in your retirement accounts, aren't easily or cheaply turned into cash you can use to pay bills. Therefore, you also need to make sure you have enough cash (or assets you can convert to cash) to pay your debts as they come due. Tracking Your Net Worth Over Time While knowing your net worth at any given time can be useful, you should also track how your net worth changes over time.

Despite the launch of Quicken, the makers have continued to develop SEE Finance into a very reliable, robust and feature packed personal budgeting app for Mac. In fact the latest version of SEE Finance 2 has been built from the ground up and is a big improvement on in terms of both looks, functionality and affordability. We found that SEE Finance 2 is one of the best personal finance software for Mac when it comes to importing Quicken QIF data accurately. Unlike apps such as Banktivity and Moneydance, there’s less chance of duplicated transactions when importing large QIF files into SEE Finance. You can import files in QIF, QMTF, CSV, QFX and OFX format. Investment tracking is also very well done in SEE Finance 2 with a clear and varied overview of your investments with lots of different reports. SEE Finance 2 is also very good at handling multiple currencies with over 150 different currencies supported.

We set up accounts with our five front-runners, downloaded every app, and then got to work hooking up our bank accounts, tinkering with settings, tracking our finances, and building budgets. We logged in every day for a month, checking to make sure transactions were imported properly, monitoring our spending trends, and seeing whether they helped us stick to our budgets with prompts and warnings. Overall, we were pleased with our top contenders.

Mint has improved a lot over the years and has faced less criticism than Quicken, partly because it doesn’t cost a cent to use. Mint is all about getting your money in order and is based around three things: • Budgeting: Mint will automatically suggest a budget for you based on your income and goals. You can factor in one off expenses and of course recurring monthly costs.

Note that there’s no support for Direct Connect or Bill Pay though. YNAB also does not support multiple currencies or investment tracking so it’s not really suitable for those who have a big investment portfolio.

Although there’s dedicated for this, there seems little reason why Personal Capital can’t make things easier when it comes to declarations. Overall though, Personal Capital not only helps you budget better but it manages your investments too and it’s so convenient to have that all in one app. For more information, you can check out our full. You can also to judge for yourself. Pricing: Free. If Cloud based apps are not your thing and you want a dedicated Mac desktop app, (formerly Fortora Fresh Finance) is an excellent no-nonsense personal budgeting software for both Mac and Windows.

The software will automatically fill them in, but we noticed that it’s not as smart about labeling budgets as it is with transactions. (It slotted a bus pass into “Education,” for example). You may have to do a little tinkering initially to set it straight. Why we chose it Ad-free Quicken is made by Intuit, the same parent company as Mint.

Moneydance will also download stock prices automatically in real time. Moneydance also has some powerful reporting tools that compare favorably with Quicken and it can generate reports for any of your accounts, savings or investments. The are both free so you can manage your budgeting on the move although it’s only really useful for manually inputting transactions. Slightly concerning though is the fact that Moneydance only syncs the Mac and iOS app via Dropbox which doesn’t feel very secure compared to Banktivity’s encrypted Direct Access features.

To figure your net worth, you need to figure out how much everything you own is worth and how much money you owe to various creditors. Using a computer program, such as Quicken, can help you keep your finances in order and make calculating your net worth a piece of cake Net Worth Formula At the most basic level, your net worth is a measure of your assets minus your liabilities. Your assets include money or things that are worth money, such as investments, retirement accounts, real estate, paintings or cars.

It also has a comprehensive cost of living retirement calculator which gives you useful insights into your average net worth by age. In fact Personal Capital is easily the best retirement planning software for Mac available. • It’s as secure as any bank out there.

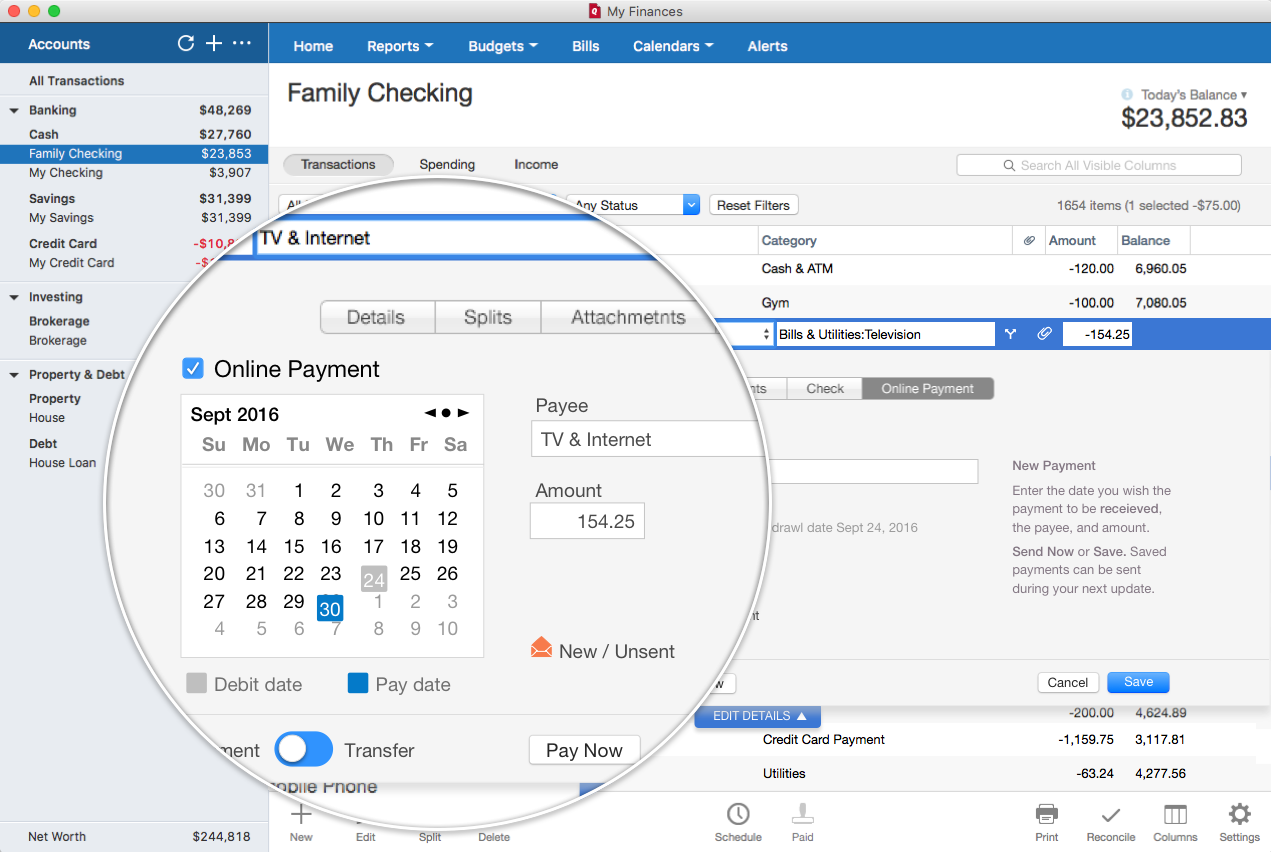

Here are a couple of other new features: • Membership Based Program: Instead of purchasing an upgrade every year, Quicken members pay an annual fee and automatically get upgraded each time a new version rolls out. • Online Billing Access: Quicken now integrates with more than 11,000 billers, and it lets you download PDF copies of your bills right to Quicken.

You can also to judge for yourself. Pricing: Free. If Cloud based apps are not your thing and you want a dedicated Mac desktop app, (formerly Fortora Fresh Finance) is an excellent no-nonsense personal budgeting software for both Mac and Windows. Moneyspire doesn’t store your accounts in the Cloud, doesn’t require you to upgrade regularly or subscribe like Quicken and you can download it onto your Mac.

Download safari 4.0.3 for mac. Shared Assets.

If you’re a US college student,. You can also try a of YNAB before deciding whether its for you or not. If you’re struggling to make ends meet at the end of the month, YNAB is an excellent straightforward budgeting alternative to Quicken. Pricing: $49.99/Year – Free Trial.